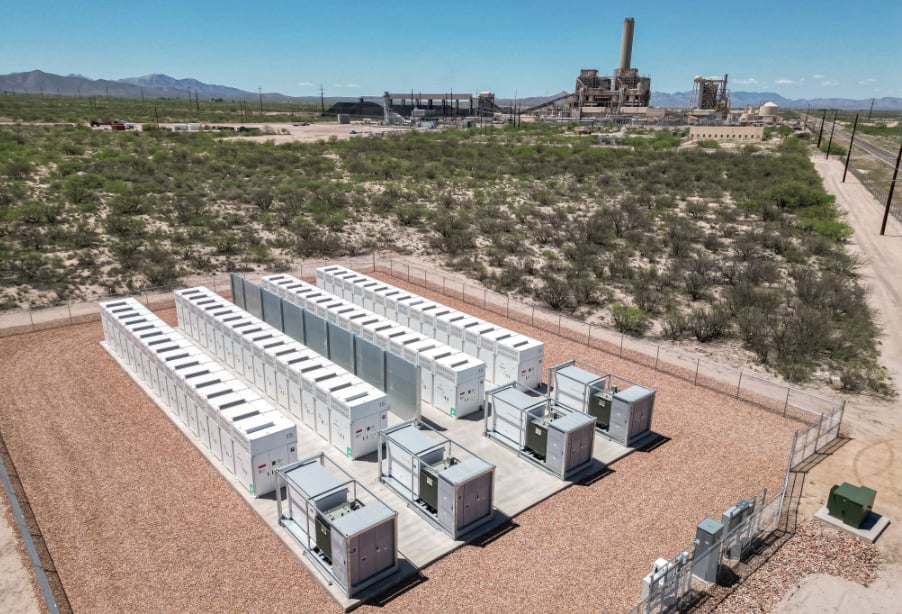

System integrator Stem Inc has seen huge falls in quarterly revenue and bookings as it shifts its business model away from BESS hardware solutions towards higher-margin software and service offerings.

The NYSE-listed firm saw US$29.3 million revenues in the third quarter of 2024, down 78% from the same period last year, while bookings fell a staggering 96% to US$29.1 million.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

However, its GAAP gross profit was US$16.2 million, up from a US$20 million loss a year ago, while the non-GAAP margin was 46%, up from 12%.

Its net loss for the period did double to US$148.3 million, versus $77.1 million in 3Q23, but that included US$104.1 million of “bad debt expense associated with impairment of accounts receivable related to customer contracts that provide a parent company guarantee”, the company said.

The falls in revenue reflect “revised negotiated valuations of assets under certain hardware price guarantees entered into in 2022 and 2023” and “reduced battery hardware sales”.

The results reflect the company’s shift away from providing battery energy storage system (BESS) hardware solutions to focusing on software and services associated with BESS projects, a shift revealed in October after the company was warned by the NYSE about its low share price in September. Interim CEO David Buzby explained the shift in Stem Inc’s Q3 earnings call with analysts.

“This year, the unpredictability of project timelines for utility-scale storage hardware persisted, prompting a strategic shift to reduce our reliance on this revenue stream. These timeline challenges resulted in significantly lower than expected bookings, revenue and accounts receivable collections,” Buzby said.

The downturn for the company’s BESS activity was first noted in Q1, before further weak results in Q2 prompted a strategic review.

Buzby continued: “We expect our refined strategy to accelerate the growth of more predictable revenue from software and services. Through our consultative energy services offering, we aim to generate revenue earlier in the project lifecycle, independent of potential interconnection or permitting delays positioning services as a gateway for software sales. By emphasising our software and services offerings, we believe that we also have a clear path to gross margin expansion and profitability.”

The firm was one of numerous in the energy storage space to go public via special purpose acquisition company (SPAC) listings.

Earnings call transcript from Seeking Alpha.