With more than 3GW of new deployments in the second quarter of this year, “energy storage is becoming a mainstay of the power grid” in the US.

Those were the words of John Hensley, SVP of markets and policy at the American Clean Power Association (ACP), commenting on figures and findings from Wood Mackenzie’s quarterly ‘US Energy Storage Monitor’.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The research firm has just published the Q3 2024 edition of the report, featuring market statistics from Q2.

It found that grid-scale energy storage saw its highest-ever second quarter deployment numbers to date, at 2,773MW/9,982MWh representing a 59% year-on-year increase. This was part of a total 3,011MW/10,492MWh across all market segments, which were, in turn, the second-highest Q2 numbers on record.

“Energy storage is becoming a mainstay of the power grid, delivering a more resilient and affordable grid. Additional storage capacity across U.S. markets is helping to provide a cost-effective and reliable solution to serious problems such as rising energy demand, a timely need for more overall capacity, and more volatile and extreme weather events,” Hensley said.

That said, deployments remain quite geographically concentrated in the leading markets by state. Just three states, California, Arizona and Texas, accounted for 85% of grid-scale deployments in capacity (MWh) terms.

California continues to lead the way across both grid-scale and distributed market segments—the latter comprising residential, commercial & industrial (C&I) and community storage.

The Golden State accounted for 40% of all new Q2 capacity (4,492MWh), Arizona for 23% (2,600MWh) and Texas for 20% (1,200MWh).

In terms of grid-scale project numbers, there was a minor surprise in that Colorado came second with five to California’s seven, but the Colorado projects were of small average size and only added up to 51MW of output—around 5% of California’s new capacity.

The top three line-up does mark a departure from Q1’s, as featured in Wood Mackenzie’s last quarterly report, when Nevada was top, followed by California and Texas.

However, Arizona’s strong showing to break the top three is perhaps unsurprising to regular readers of Energy-Storage.news given the sheer volume of development projects and utility off-take deals reported over the last few months on this site.

In late June, utility Salt River Project (SRP) and developer Plus Power held an event to inaugurate two new projects totalling 1,360MWh in Arizona’s Maricopa County, while in March (admittedly outside the Q2 period reported by the new edition of the Monitor), Arizona’s largest battery energy storage system (BESS) to date came online, again with SRP’s involvement for developer NextEra Energy Resources’ (NEER’s) 1GWh project in Buckeye.

Arizona and California BESS projects, which are often co-located with solar PV, typically have 4-hour duration systems, compared to 1-hour and 2-hour assets more commonly seen in Texas.

Average grid-scale battery storage costs declined 4% in Q2, far from the 39% quarter-on-quarter decline recorded in Q1. Lithium prices were relatively steady, seeing a slight decline during the second quarter.

Interconnection, permitting challenges persist

Despite the growth, it isn’t all plain sailing for the US energy storage sector, ACP’s John Hensley said.

“To keep the trend going, it’s important to find solutions for development challenges such as lengthy interconnection queues and permitting and siting,” Hensley said.

The highest quarterly deployments on record so far were registered in the final quarter of last year. Q4 2023 saw 4,235MW/12,351MWh across all segments including 3,983MW/11,769MWh at grid-scale.

That may not remain the record for long. In June, Wood Mackenzie predicted that 2024 will be the first calendar year in which total new deployments in the US exceed 10GW—a milestone Europe surpassed last year with 10.1GW. Interestingly, European installs were dominated by residential energy storage, comprising about 70% of the market, inverting the US trend.

“This quarter showed massive growth compared to year-ago levels, and the grid-scale segment continues to be the main driver,” Wood Mackenzie senior energy storage analyst Vanessa Witte said of the latest numbers.

Witte noted, however, that while community storage did well, it was a “somewhat slow” quarter for the US residential segment, which saw 209MW/423MWh deployed. This was a 15% decrease from Q1 2024, although national storage attachment rates for residential solar PV continued to rise and reached 26%, a new record.

Growth to flatten in next couple of years

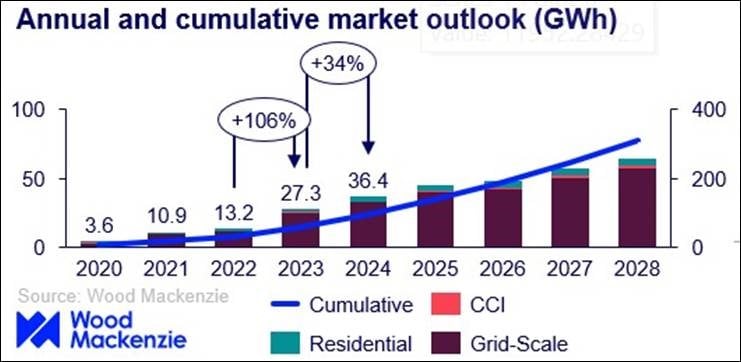

Wood Mackenzie predicts that 11GW/32.7GWh of grid-scale deployments will be made throughout 2024, a total 32% year-on-year increase from 2023. Across all segments, 12.8GW/36.9GWh is predicted.

The firm’s database shows a further 6.1GW of grid-scale projects scheduled to be constructed this year, set to account for a strong showing in Q3 and Q4.

However, those challenges ACP’s John Hensley mentioned, around permitting and interconnection times—identified as industry headwinds in Wood Mackenzie’s previous US Monitor reports—will persist, flattening growth in 2025 and 2026.

It could likely result in growth slowing down from around the 42% mark across all segments between 2023 and 2024 to just 7.6% between 2024 and 2028. Wood Mackenzie expects to see 62GW of cumulative grid-scale deployments in that five-year timeframe, and about 12GW of distributed-scale deployments, of which the vast majority, about 10GW, will be residential.