The Biden Administration will more than triple the tariffs paid on batteries and battery parts imported into the US from China, from 7.5% to 25%, in a huge move for the industry.

In a Fact Sheet issued by the White House today (14 May), the Administration said it would increase the tariff rate on lithium-ion batteries for electric vehicles (EVs) from 7.5% to 25% in 2024, and the tariff rate for non-EV lithium-ion batteries from 7.5% to 25% in 2026.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

The tariff rate for battery parts will also increase from 7.5% to 25% in 2024, tariffs for natural graphite and permanent magnets will go from zero to 25% in 2026 and tariffs for certain critical minerals will go from zero to 25% in 2024.

The move is part of a raft of measures that the White House said would “…protect American workers and businesses from China’s unfair trade practices”. The measures include hiking solar cell tariffs from 25% to 50%, EVs from 25% to 100%, and doing the same on other industry products like cranes and medical equipment.

“China is also flooding global markets with artificially low-priced exports. In response to China’s unfair trade practices and to counteract the resulting harms, today, President Biden is directing his Trade Representative to increase tariffs under Section 301 of the Trade Act of 1974 on US$18 billion of imports from China to protect American workers and businesses,” the statement read.

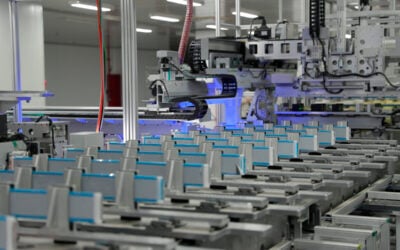

China dominates the global lithium-ion battery market with 80-90% of manufacturing, and more for certain key components and minerals.

The ‘stick’ alongside the Inflation Reduction Act ‘carrot’

Tariffs have been levied on batteries and other clean energy technology products, particularly solar cells, since 2018 under the previous Trump Administration.

The existing 7.5% rate for batteries rises to 10.89% when importing full containerised battery energy storage system (BESS) products containing lithium-ion cells from China.

The tariffs go hand-in-hand with Biden’s Inflation Reduction Act which provided an array of tax credit subsidies and funding pots for upstream and downstream clean energy industries including batteries and BESS, but some had argued that ever lower prices from China would continue to threaten the US industry’s competitiveness.

Energy-Storage.news heard from some delegates at Solar Media’s Energy Storage Summit USA 2024 in Austin, Texas, in March that further curbs on China imports could be imminent.

Non-EV batteries’ later implementation date

It is notable and perhaps unsurprising that lithium-ion batteries not destined for the EV market will be subject to the higher tariff two years later than those for EVs.

The Inflation Reduction Act has led to a boom in US battery manufacturing projects but the vast majority of the announced capacity is set to go to the EV industry.

The 2026 date gives BESS manufacturers an extra two years to source US-made cells to protect themselves from the new 25% tariff.

BESS manufacturers were already looking at ways to secure local cell capacity before this announcement, in order to take advantage of a domestic content tax credit for BESS projects and a generous US$35 per kWh of battery cell production. The new tariff provides a huge additional reason to do so, by increasing the cost of Chinese batteries by nearly a fifth.

Even without the increased tariff, consultancy Clean Energy Associates (CEA) recently estimated that US-made BESS products were set to become cost-competitive with those from China next year.

Energy-Storage.news’ publisher Solar Media will host the 2nd Energy Storage Summit Asia, 9-10 July 2024 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.